As an employer, you must know how to change unemployment rate in QuickBooks for accurate tax calculations. SUI rate assessments are updated yearly for employers. These assessments update the experience rate for unemployment contributions. Failure to update the SUI rate in QuickBooks can cause calculation errors and compliance problems.

This guide provides step-by-step instructions to change the unemployment rate in QuickBooks.

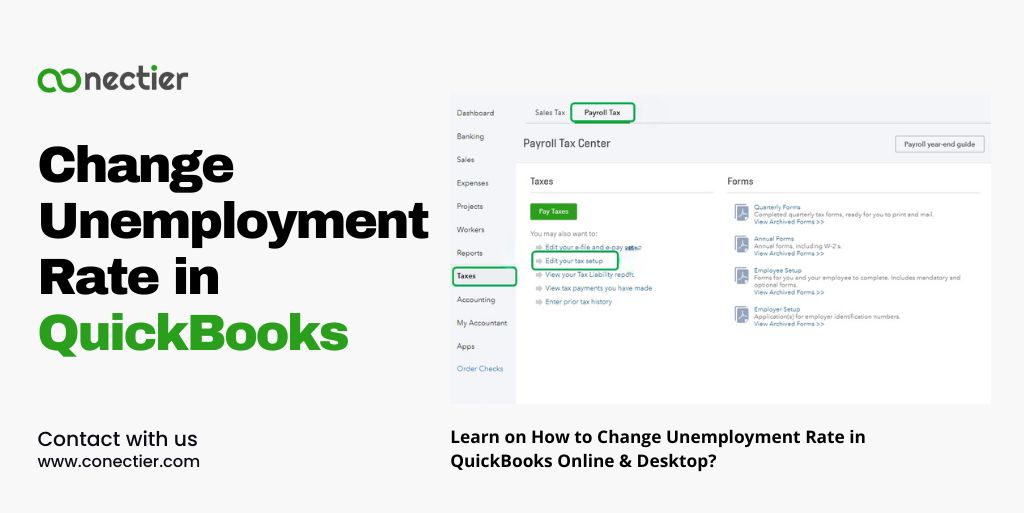

How to Change State Unemployment Insurance Rate in QuickBooks Online?

Learn how to change unemployment rate in QuickBooks Online for Elite, Premium, or Core versions.

- Access your QuickBooks Online account.

- Select Payroll Settings under Settings.

- Click Edit after choosing state for SUI rate update.

- Change or add a new rate by selecting the option in the State Unemployment Insurance rate setup section.

- Input new rate and date. January 1st is the effective date for most states. Residents of TN, VT, or NJ effective July 1st.

- Add surcharge or assessment tax rates, if any.

- Save changes by clicking OK.

Note: For QuickBooks online enhanced payroll users, the steps to change the sui rate is similar as above

Vital Tips to Change Unemployment Rate in QuickBooks for Enhanced and Standard Payrolls

Use these tips to change SUI rates for QuickBooks online for enhanced or standard payrolls, as outlined.

- First, select Reports, then Employees and Payroll.

- Set quarterly tracking for the date.

- Choose the info and design accounting report by clicking.

- Date required for accuracy.

- Name of report source required.

- Your payroll item?

- Payroll Salary Caps.

- Specified paycheck amount.

- Select payroll items from the List by using filters while doing this.

- Obtain payroll items with a single click. Select State Unemployment.

- Analyze the Total salaries column to improve current rate.

- Match all computed sums.

How do I Change the Unemployment Tax Rate in QuickBooks Payroll Full Service Users?

If you are using QuickBooks Online Payroll Full Service, follow these steps to change the SUI rate:

- Sign in to QuickBooks Online.

- Access Help.

- Choose Contact Us to connect with an agent who can help you update your State Unemployment Insurance rate.

How to Change Unemployment Rate in QuickBooks Desktop?

QuickBooks Desktop has strong payroll features, but updating the unemployment rate is manual.

1. Updating SUI Rate in QuickBooks Desktop Payroll

To change State Unemployment Rate in QuickBooks Desktop Payroll, follow these steps:

- Access Payroll Item List from the Lists section.

- Open [state abbreviation] – Unemployment Company by double-clicking.

- Keep clicking Next till you arrive at Company Tax Rate page.

- Input the accurate rates for each quarter.

- Finish the process by clicking Next, then Finish.

2. Updating SUI Rate in QuickBooks Desktop Payroll (Surcharges or Assessments)

If you have surcharges or assessments, you need to change additional SUI rates in QuickBooks Desktop. Here’s how:

- Click on Payroll Item List in the Lists menu.

- Open State Surcharge with a double-click.

- Follow the on-screen directions after clicking Next.

- Enter the rate in the percentage form on the Company Tax Rate page.

Things to Consider on How to Change Unemployment Tax Rate in QuickBooks Desktop.

Businesses pay federal and state unemployment taxes to cover benefits for jobless workers. Employer pays unemployment tax and files IRS Form 940. Many states have an unemployment tax. Federal and state tax rates are saved in QuickBooks.

Follow the instructions below:

- Select “Pick List” from the main menu.

- Find the unemployment benefit. Click Edit.

- Changing the tax rate.

Unemployment tax rate has been altered. The state unemployment tax rate can be modified by locating the item in the list.

Verifying Payroll Items on Employee Paychecks.

You must verify payroll items on employee paychecks when any change to unemployment tax rate in QuickBooks is made.

- Go to Lists and choose Payroll Item List.

- Choose pay stub deductions, additions, and company contributions.

- To open Tax Tracking Type window, click next.

- Tax Tracking type determines the taxability and reporting of payroll items.

- Verify if the chosen kind matches your requirements in the description.

- If uncertain about tax tracking type, seek advice from an accountant or tax counselor.

- Edit payroll items with incorrect tax tracking to inactive.

- Ensure tax tracking type and use the new payroll item on upcoming paychecks.

As a employer, you must change the unemployment rate in QuickBooks to ensure accurate payroll calculations and compliance with state requirements. Whether you are using QuickBooks Online or QuickBooks Desktop.

Frequently Asked Questions

The unemployment rate should be updated annually or whenever you receive a new rate assessment from your state.

If you enter an incorrect unemployment rate in QuickBooks, it can result in inaccurate payroll calculations and potential compliance issues.

Yes, you can.

Yes, you can change the unemployment rate mid-year in QB

If you have surcharges or assessments for state unemployment, you can update the additional rates in QuickBooks.

Yes, QuickBooks offers customer support options that can assist you with any questions or issues related to changing the unemployment rate in QuickBooks.

If you encounter any difficulties or issues while changing the SUI rate in QuickBooks Desktop payroll, seek help from QuickBooks Desktop Payroll support.

While it is best practice to update the SUI rate annually, if the rate has not changed, you may not need to update it in QuickBooks.

QuickBooks typically applies rate changes to future transactions only.

It is recommended to contact your state’s unemployment division to confirm the amount overpaid.

Yes, if you have QuickBooks Online Full-Service Payroll, you can update the SUI rate by reaching out to the QuickBooks support team.

It is recommended to review and update your payroll tax rates in QuickBooks Desktop annually to ensure accuracy and compliance with state regulations.

To find your current tax rate for State Unemployment Insurance (SUI), you can refer to the notice you receive from your state’s unemployment division.

Yes, you can change the state unemployment tax rate in QuickBooks Online for multiple states.