A clearing account in QuickBooks serves the function of temporarily holding funds before they are transferred to their final destination. It is also known as a barter or wash account. Unlike other accounts, a clearing account always maintains a balance of zero because the amount deposited is always taken out. It helps to move money between accounts without changing the balances directly.

In this blog, we will explore how to set up a clearing account in QuickBooks, and how to use it in QuickBooks.

- How to Use a Clearing Account in Quickbooks?

- How to Create QuickBooks Clearing Account?

- How to Start Using a Clearing Account in QuickBooks?

- How to Set Up a Clearing Account in QuickBooks Online?

- How to Set Up a Payroll Clearing Account in QuickBooks?

- Why to Use a Payroll Clearing Account in QuickBooks Online?

- How to Remove Cash Clearing Account in QuickBooks Online?

- How to Reconcile a Clearing Account in QuickBooks?

- What are the Benefits of Using a Clearing Account in QuickBooks?

- Frequently Asked Questions

How to Use a Clearing Account in Quickbooks?

Here are the common use of a clearing account in QuickBooks. For multiple uses, it’s recommended to create separate accounts.

Managing customers and accounts receivable

- Manage bad debt using the accrual method.

- Transfer a Credit Note from one job to another job for the same customer.

- Transfer funds between Account Receivable accounts.

- A zero cheque can be used to allocate overhead expenses to customers or classes.

- Create a single check that pays invoices for two customers.

Supplier management and accounts payable.

- Move funds from one Account Payable account to another.

- Note down a reimbursement cheque from one supplier on behalf of another supplier.

- Reassign a Bill or Bill Credit to a different Supplier. Consolidating bills.

Others Uses

- Transfer foreign currencies without the need for currency exchange.

- Clear a receivable with a payable.

- Keep track of trade transactions with a company that is both your supplier and customer.

How to Create QuickBooks Clearing Account?

As a user of the program you may want to create QuickBooks clearing account. Just follow the steps below on how to proceed doing it.

- Choose Chart of Accounts from Lists.

- Select New by right-clicking on the Chart of Accounts.

- Pick the bank of your choice.

Note: Choose a bank account for the below reasons.

- Receive Payments or Make Deposits allows you to deposit funds into a bank account.

- Use Write Checks or Pay Bills to pay from a bank account.

- The balance and changes of bank account will be displayed on financial sheet and cash flows report.

- To assign expenses, pick the bank as a the clearing account.

- Ensure to use a zero type check.

- Proceed with Continue.

- In the name field of the account assign whether it is a clearing, barter, or wash

- Do not enter any initial balance.

- Select the Save & Close option.

How to Start Using a Clearing Account in QuickBooks?

Once you have finished with the setup process, you can begin using the clearing account QuickBooks by following the below steps.

- Form a journal entry.

- Once done, to move money add the AR or AP

- Insert the Clearing account.

- Once finished, save the Journal Entry.

- Now make a second Journal Entry.

- Again insert the Clearing Account.

- Specify the AR or AP account for the money transfer.

- Connect Journal Entries in Pay Bills or Receive Payments.

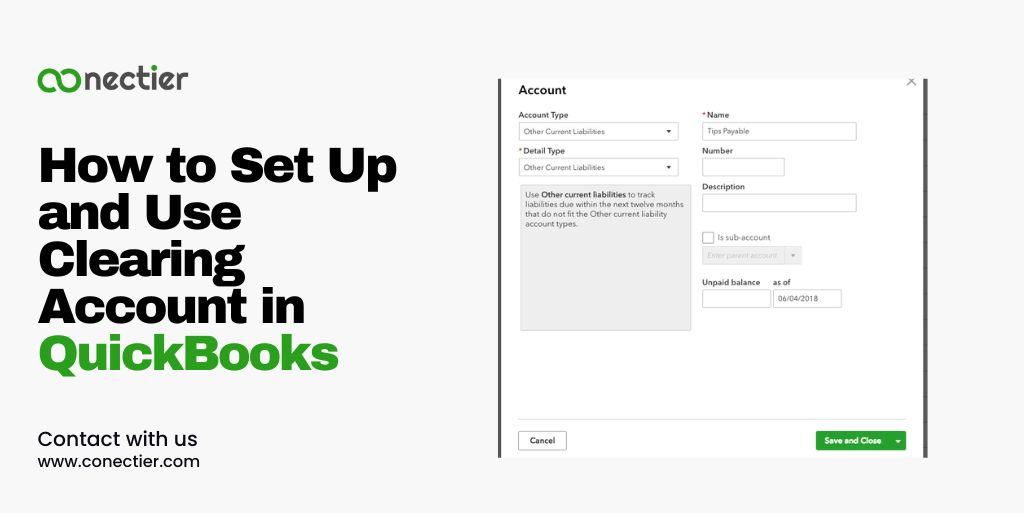

How to Set Up a Clearing Account in QuickBooks Online?

If you are using the online version of the accounting program and wish to set up a clearing account in QuickBooks online follow the given procedure below:

- Go to Accounting by signing into your QuickBooks account and clicking on it in the left-side panel.

- Pick Chart for Accounts.

- Click the New tab on the Chart of Accounts screen.

- Select Bank for Account Type. Choose any detail type for your clearing account.

- Enter the clearing account name.

- Don’t input the balance before clicking Save and Close.

How to Set Up a Payroll Clearing Account in QuickBooks?

Setting up a payroll clearing account in QuickBooks requires a few additional steps. Here’s a straightforward guide to help you get started:

- Verify with your accountant or payroll provider to decide the correct account for payroll clearing.

- Click “New” on QuickBooks’ Chart of Accounts tab.

- Pick the suitable account type for your payroll clearing account. (Banking organization).

- Include an account description and all necessary information.

- Save and close it.

With your payroll clearing account set up, you can now record payroll transactions and easily reconcile them at a later stage.

Why to Use a Payroll Clearing Account in QuickBooks Online?

Clearing payroll is a charge for payroll dues and deductions. Using a payroll clearing account in QuickBooks Online offers efficient analyses. If there are any issues in the payroll setup, you solve them by using the steps below.

- Select Audit Log from the Settings menu.

- Select Filter.

- Narrow results by selecting events, users, and date

- Click to apply.

- On the history column, tap on view.

- Any type of changes made will be shown.

How to Remove Cash Clearing Account in QuickBooks Online?

If you no longer using cash clearing account in QuickBooks online, you can simply follow the steps listed below to remove or unlink it.

- Head to Banking.

- Select the clearing cash account tile.

- Select Edit account info after tapping the Pencil icon.

- Tick the Disconnect on the save option.

- Save and close with a click.

How to Reconcile a Clearing Account in QuickBooks?

Reconciling a clearing account is a crucial step to ensure the accuracy and integrity of your financial records. Follow these steps to reconcile clearing account in QuickBooks effectively:

- Select Reconcile from the Accounting tab on the left.

- Select the clearing account to reconcile.

- Enter the bank statement’s ending balance and date.

- Match QuickBooks transactions with bank statement transactions.

- Clear transactions that match the bank statement.

- Resolve discrepancies accordingly.

- Click “Finish Now” to complete the process after reconciling all transactions.

What are the Benefits of Using a Clearing Account in QuickBooks?

Using a clearing account QuickBooks offers several benefits:

- A clearing account allows you to transfer funds between accounts without directly affecting their balances, providing flexibility in managing your finances.

- By using a clearing account, you can ensure that the transactions are accurately recorded and easily traceable.

- Clearing accounts helps keep your financial records organized and makes it easier to reconcile accounts.

- The use of a clearing account creates a clear audit trail, making it easier to track the movement of funds within your business.

Now that you know what is a cleating account in QuickBooks is and how it serves as a valuable tools, allowing you to temporarily record transactions before transferring them to their respective accounts. By following the steps outlined in this guide, you can set up clearing accounts, utilize them effectively, and reconcile them accurately.

Frequently Asked Questions

A clearing account in QuickBooks is a temporary holding account used to record transactions before transferring them to their respective accounts.

To create a clearing account in QuickBooks, navigate to the Chart of Accounts, click “New,” link it to a bank account, provide the necessary information, and save it.

Yes, you can set up a payroll clearing account in QuickBooks.

Yes, you can but clearing accounts do not require reconciliation as their purpose is to temporarily hold funds and facilitate transfers between accounts.

To clear a clearing account in QuickBooks, you can create journal entries to transfer the funds to their final destination accounts.

Yes, you can use a clearing account for payroll in QuickBooks to temporarily hold funds before transferring them to employee accounts.

Yes, you can create multiple clearing accounts in QuickBooks to handle different types of transactions and maintain accuracy in your financial records.

To create a payroll clearing account in QuickBooks, follow the same steps as setting up a regular clearing account and designate it specifically for payroll transactions.

Yes, you can use a clearing account to track accounts receivable transactions before transferring them to the appropriate accounts.

It is recommended to periodically clear your clearing accounts to ensure accurate and up-to-date financial records.

Using a clearing account provides flexibility, accuracy, organized records, and a clear audit trail for the movement of funds within your business.