Using a credit card to make payments can make the process easier and quicker. However, you may be unaware that a certain percentage of the transaction amount is deducted every time you utilize your credit card to execute payments. Apart from being charged, it is also essential that this cost is recorded properly. To record it, you can use QuickBooks. That is why you should have an idea about How to Add Credit Card Processing Fees in QuickBooks Desktop & Online.

The credit card charges can be recorded in multiple versions of the program such as QuickBooks Online and Desktop. Hence, for higher effectiveness, choose the method based on the software version installed since the steps can vary.

1. How to Add a Credit Card Processing Fee in QuickBooks?

A user needs to maintain a record of the credit card costs borne by him/her. Thus, adding the QuickBooks fee for credit card processing using the Get Paid and Pay option can be helpful. This tab is easily accessible on the homepage of the accounting software. Another way that can be utilized for entering the processing fees can be processed with the help of the Expense button.

1.1) Method 1: Use the Get Paid and Pay Tab

As the name suggests, the Get Paid and Pay feature keeps a track of all the QuickBooks charges that are received in the software. Additionally, this option records processing fees of credit cards as payments that are to be made from the accounting program. While moving through the menu panel, you can locate the Get Paid and Pay button. Then you will have to head to the Product & Service tab to give effect to its function.

To gain knowledge on how to account for credit card processing fees in QuickBooks, move through the instructions provided below:

- Open the “QuickBooks” window.

- Opt for the “Get Paid and Pay” option located on the left.

- Then hit the tab named “Product & Service”.

- Choose “New”.

- Next, you are required to select the “Service” option.

- The item of the services such as “Credit Card Fees” needs to be mentioned here.

- Now, the account through which you’ll keep tracking the credit card charges needs to be picked.

- After you have finished the procedure properly, press “Save &Close”. With this, your credit card cost would get recorded.

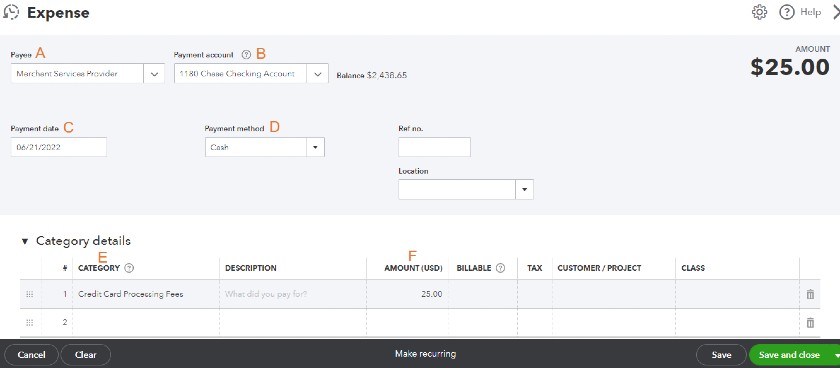

1.2) Method 2: Through Expense Button

The Expense button keeps the data regarding the payments to be done through the accounting software. The fees for a credit card can be entered via this button as well. While you try to understand how to add a credit card processing fees in QuickBooks via this, you will have to keep the invoice details handy. They will be required later to complete the procedure.

- On the homepage of the software, find and tap on the “+New” tab.

- Next, head to the column of “Vendors”.

- Here, the “Expense” feature needs to be clicked.

- You then have to enter the appropriate credentials in the following fields:

- “Payee”

- “Payment Account”

- It is important that you remember the date on which the payment was processed and the method of payment. This information will be asked in the “Payment Date” and “Payment Method” panels, respectively. If not entered correctly, then the fees may not be recorded in the proper way.

- After filling both, you need to move toward the “Category” section. Here, enter the name of the expense account through which the payment will be carried out.

- Now, mention the total cost in the “Amount” part.

- Lastly, the “Save and Close” button has to be tapped.

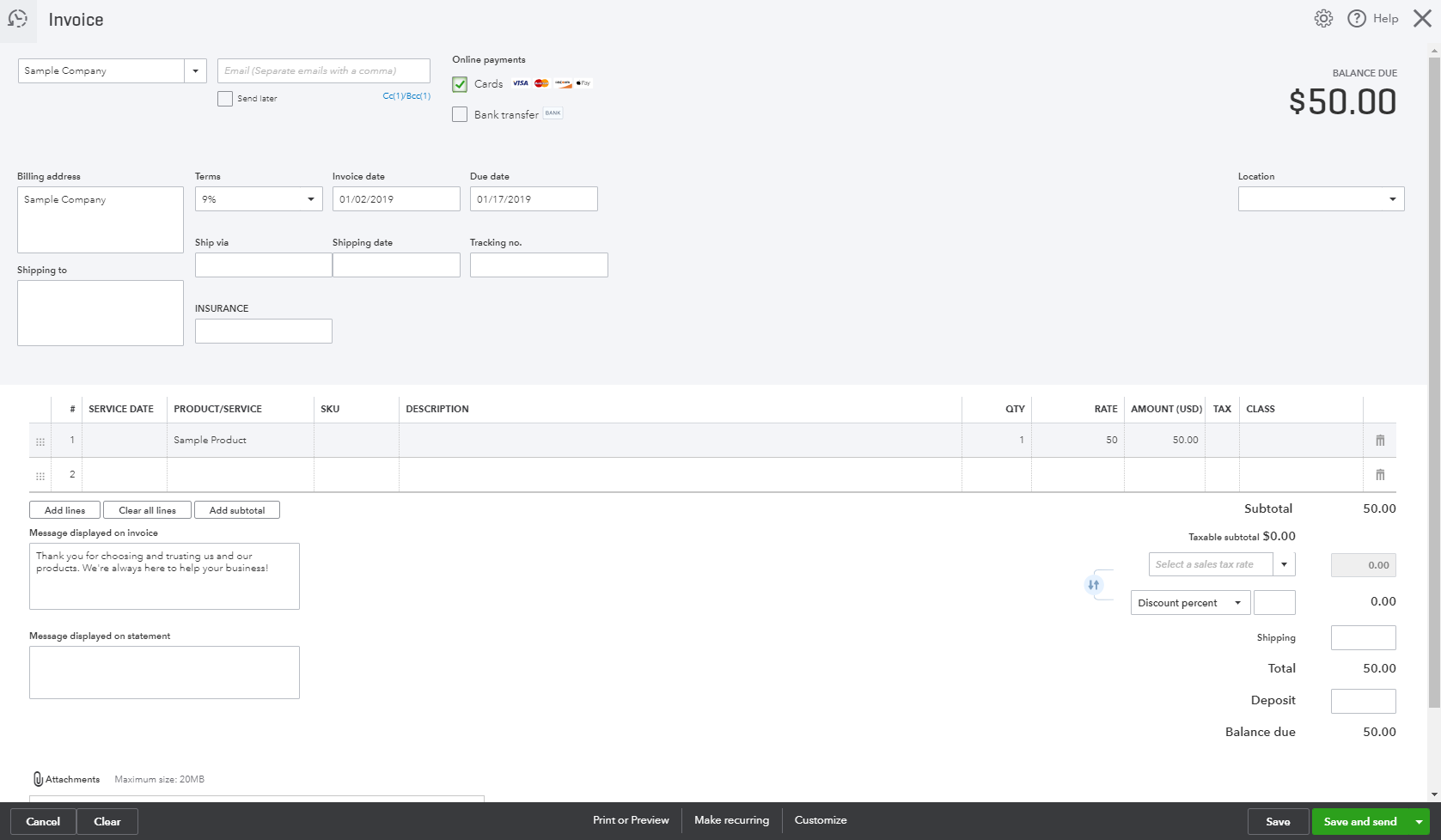

2. How to Record Credit Card Processing Fees in QuickBooks Online?

Entering credit card processing fees can be accomplished manually in the QuickBooks Online program. The procedure can only begin when the invoice relating to the fees has been created. If not, then you need to add a new one first and then navigate toward the Receive Payment page. Here, the credit card fees have to be added to the Undeposited Funds account. Once you do so, the procedure for recording the bank deposit has to be carried out.

How to record credit card processing fees in QuickBooks Online can be learned via the given steps:

- Tap on the “+” sign.

- Choose the “Invoice” button and mention the accurate amount that has to be recorded.

- Save it and go back to the “Invoice” tab.

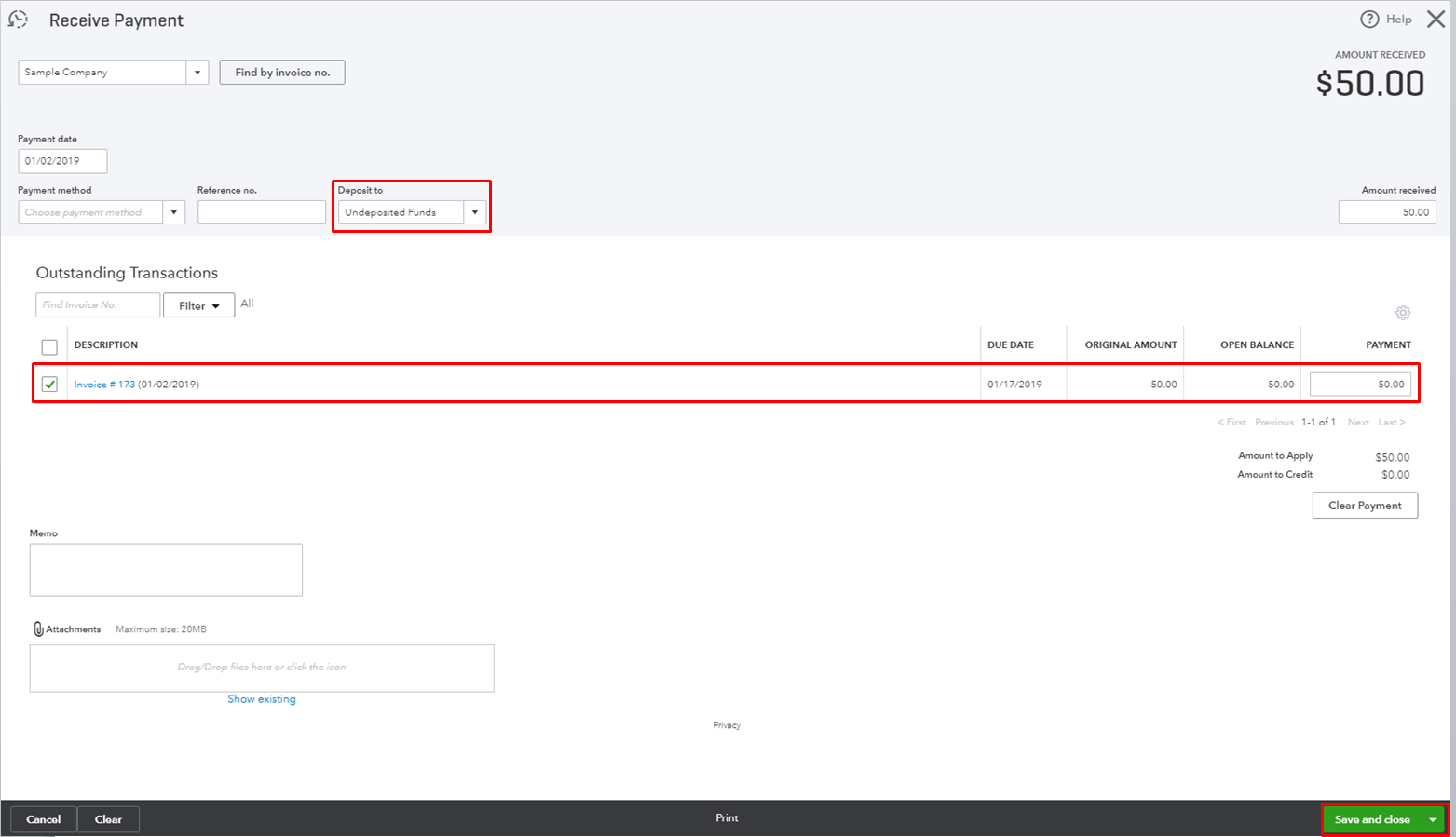

- Hit “Receive Payment” then.

- Here, you will have to select the right invoice.

- Then head toward the field of “Deposit To”.

- When you want to complete the procedure correctly, you should be familiar with the use of “Undeposited Funds”. Press the feature. Also, make sure that the invoice details are ready so that you can enter them accurately as required.

- Opt for “Save and Close” to move further.

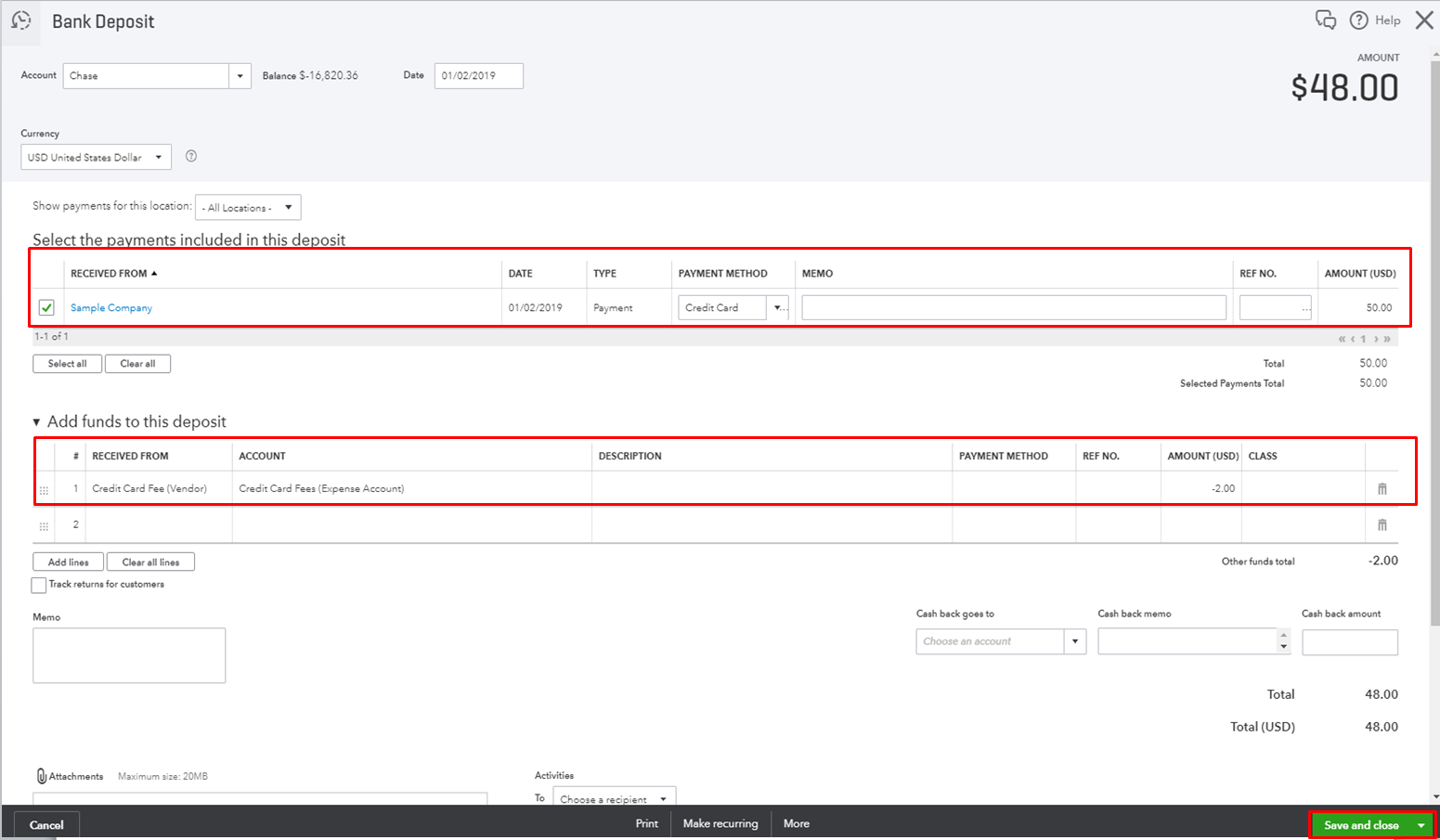

To record the bank deposit of the credit card processing fee, keep following the procedure added below:

- Navigate to the home screen of the software in the Online version of QuickBooks add credit card fee to invoice.

- After this, you are required to hit the symbol depicting “+”.

- The “Bank Deposit” button has to be tapped in this step.

- Then proceed towards the section named “Select the Payments Included in this Deposit”.

- Next, you need to visit the “Add Funds to this Deposit” panel for adding a fresh line.

- Further, go to “Received From” and mention the charges of the credit card.

- Head to “Account” and type “Credit Card Fee” in the provided field.

- You now have to put the amount as negative in the section of “Amount”.

Note: It is to be ensured that the deposit and the amount of the deposit of the net bank match each other.

- Choose the “Save and Close” tab finally to add credit card processing fee to QuickBooks invoice in the Online version.

3. How to Account for Credit Card Processing Fees in QuickBooks Desktop?

The Customer section contains a wide range of items related to the details of the customers. Bills, fees, and other similar items are included here. Therefore, when trying to add the credit card processing cost in QuickBooks Desktop, you can navigate through this section. After hitting the +New button, the Customers tab will appear. When the drop-down comes, pick Receive Payments to continue.

The following steps will guide you on how to add credit card processing fee in QuickBooks Desktop:

- Hit the “+New” tab on the “QuickBooks Desktop” menu.

- Following this step, choose “Receive Payment” found below the section of “Customers”.

- Now, mention the date on which the cost of the credit card was charged.

- In the field of “Payment Method”, you will have to enter the payment processor of the client’s credit card.

- Type the details required in the panels named “Reference Number” and “Deposit To”.

- The “Save and Close” option has to be pressed now.

The credit card processing fee should then get added to your accounting program. In case the client for which you are recording the credit card fee doesn’t have a previously created account, you may add a new sales invoice.

In the End

Adding credit card charges to your accounting software is crucial. To do so, you should always know how to account for credit card processing fees in QuickBooks. Along with the right methods, you must keep financial details in hand. This will speed up the process and the fees will accurately be added to the software.

Frequently Asked Questions

Through the “Get Paid and Pay” feature, you can find the option to add a credit card fee.

Use “Receive Payment” in the software. Then enter the details of the credit card to record the fee.

Via “Vendors”, you can access “Expense”. Through this, the processing fee of a card can be added.

For processing this card fee, this software comprises a “Payment Method” option. It is to be found using “Receive Payment”.

In the “Get Paid and Pay” option, some information has to be added. Afterward, the process can be automated.

Find the “Invoice” option in this accounting software. Then utilize “Receive Payment” to start adding this fee.

After clicking on “+”, using “Invoice” is one of the ways of adding credit card processing fees.

In the form of service costs, surcharges can be added through “Get Paid and Pay”.

To charge this cost to a customer, simply use the “Product & Service” option under “Get Paid and Pay”.

Refer to your QuickBooks purchase plan to know the charges applicable for card payments.

For processing payments in this accounting software, deductions are made. These are called processing charges.

Look for “Transfer Funds” under “Banking” in this software. Then enter your transactions through this.

One can try to record these sales via “Transactions” or “Banking”.

Yes, a credit card fee can be included for an invoice in the accounting software.

The charges for credit card fees can be recorded for customer invoices.

You can add credit card processing fee to the QuickBooks invoice on the Online version of the software. Besides this, the QuickBooks Desktop program allows you to record your credit card charges.

This processing fee is a charge. It is applied by a payment processing professional. For continuing with a transaction, this fee needs to be paid. In QuickBooks, the deductions can be added to maintain a record.

It is definitely possible to record the QuickBooks fee for credit card processing as an expense. To do so, you will have to mark the credit fee as an expense in the “Payment Account” field. You simply need to type “Credit Card Fees (Expense Account)” here.

Accounting for a credit card in QuickBooks means recording the charges that have been applied while processing payments through it. The processing fee has to be added to the software to maintain a track.

To add credit card processing fee to QuickBooks invoices, you always need to have the details of the documents ready with you. Additionally, you should know the name of the payee as well as the date on which the payment was made. The payment account, method, and category can be required too.

Entering the credit card processing fee in the QuickBooks program becomes essential when it comes to maintaining proper financial records. Eventually, these records are quite beneficial at the time of account reconciliation.

To begin learning how to add credit card fee to invoice in QuickBooks Desktop, you are required to find and click on the “+New” button. From here, you will have to navigate toward the “Vendors” section. Further, the “Expense” feature has to be chosen to add the credit card processing cost.

QuickBooks does provide a feature through which the credit card processing fee can be automatically recorded. To turn this on, you need to take permission from your client whose fee has to be recorded automatically. One authorization form may have to be signed by the customer in order to give this permission.

To enter the credit card fees in QuickBooks Online, you will have to first generate an invoice using the “+” icon. Then use the “Invoice” button, respectively. After doing so, you need to mention the amount that has been charged in the provided field. Once this is done, you then have to move toward the “Receive Payment” option.