QuickBooks Direct Deposit Form transfers funds electronically via the ACH network, providing a secure and streamlined payment method that eliminates the need for paper checks. ACH technology ensures prompt and accurate transactions, enabling efficient payroll payments.

- What Are the Benefits of Intuit Direct Deposit Form?

- How to Set Up QuickBooks Direct Deposit Forms for Employees?

- What Are the Steps to Set up QuickBooks Direct Deposit for Employees?

- What Steps to Take if QuickBooks Direct Deposit Form is Late?

- How to Set a Preferred Template for QuickBooks Direct Deposit Form?

- How to Change or Update QuickBooks Direct Deposit Form?

- How to Access Employee Direct Deposit Authorization Form in QuickBooks?

- How to Set Up QuickBooks direct deposit forms for vendors?

What Are the Benefits of Intuit Direct Deposit Form?

Managing payroll can be a complex task, but using Intuit Direct Deposit Form can simplify the process. This method offers a range of benefits for both employers and employees.

- Intuit direct deposit form eliminates the need for physical checks.

- Employers initiate the transfer of employee compensation to their bank before payday.

- Funds are released to the employee’s account on payday.

- No need to wait for the physical check to clear.

- Funds are immediately available to employees upon receipt.

- Provides a convenient and efficient way to receive compensation.

- Timely access to funds is an added benefit.

How to Set Up QuickBooks Direct Deposit Forms for Employees?

Setting up direct deposit form QuickBooks for employees is a simple process that eliminates the need for paper checks and provides a convenient way to pay employees. To begin the setup process.

- Employers require employee bank details like bank name, routing, and account numbers to initiate direct deposit payments.

- You can enter employee banking information into the Intuit QuickBooks Payroll form after collecting the necessary details.

- Using the collected employee banking information, employers can schedule direct deposit payments for electronic transfer of compensation on payday.

QuickBooks Direct Deposit Forms offer a secure and efficient way to pay employees, and the setup process is straightforward to complete.

What Are the Steps to Set up QuickBooks Direct Deposit for Employees?

To set up Intuit QuickBooks Payroll form certain requirements must be met. The bank accounts must be in the US and be able to accept ACH transactions.

After confirming the prerequisites, employers can add employees to the direct deposit system QuickBooks and start experiencing the benefits of electronic payments.

Step 1: Execute the Company’s Payroll for Direct Deposit

This process is to set up your company with QuickBooks direct deposit authorization form.

A: Collect business, bank, and principal officer information.

You will need the following information to set up direct deposit for your company:

- organization name, address, and EIN

- SSN, birth date, and communication address of the principal officer

- bank authorizations for online, or the organization banking info

- Bank details for employees or contractors.

B: Link your bank account.

Instant Bank Verification may allow for immediate linking of your bank account, enabling prompt use of direct deposit for your team.

- For new users of payroll, refer to the “Connect Your Bank” section in the “Get Started with QuickBooks Online Payroll” guide.

- If you need to modify your current payroll bank account, consult the “Change Your Payroll Bank Account” instructions.

Please note that when you make changes to your bank information, you may be required to enter a code that will be sent to your phone number to save the changes.

- Log in to QuickBooks with the admin credentials.

- Click on Employees, go to the area that mentions payroll service, and then Start the direct deposit.

- If you do not see the begin or to get start button, choose admin and type the admin’s email or user identification,

- Then tap the continue button.

- Sign into your Intuit subscription or create a new one if necessary.

- Select “Get Started,” then fill out the necessary business and principal officer information.

- Add a new bank account by entering the bank name and online credentials, or routing and account numbers.

- Create a PIN and confirm it.

- Click “Submit,” then “Next,” and finally “Accept and Submit.”

- If asked, confirm the principal officer’s Social Security number, and click “Submit.”

Note: After connecting your bank account, you will receive one of the following messages:

- Bank account connected for direct deposit payments.

- Confirmation note received for authorizing QuickBooks Direct Deposit forms.

C: Authenticate the Bank Account in case the connection has failed.

- Instant connection to bank account may fail.

- Test debit of less than a dollar sent if the connection fails.

- Amount of test debit needed for account authorization.

- Allow up to two days for the test debit to appear in the account.

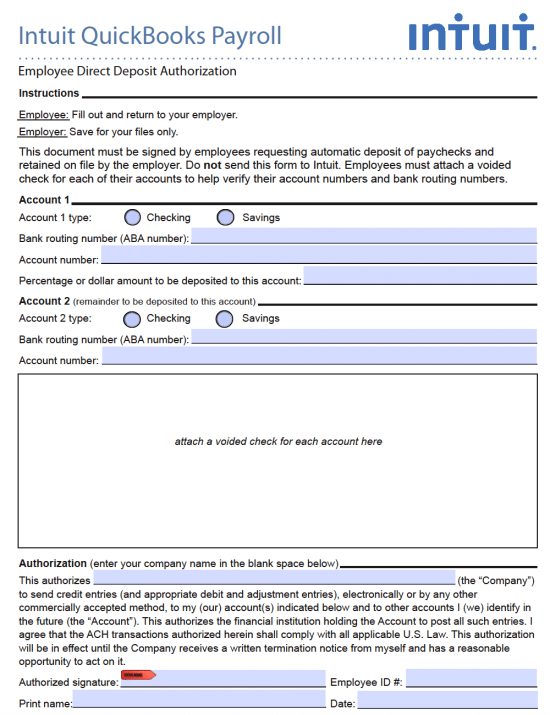

D: Obtain employee direct deposit authorization form Intuit.

Ask employees for QuickBooks direct deposit authorization form and voided check, then move ahead with payroll setup.

To get the QuickBooks Online Payroll direct deposit form:

- Go to Taxes and then Payroll Tax.

- From there, click on “Filings” and choose “Employee Setup.”

- Look for “Bank Verification” next to the Direct Deposit Authorization and click on it.

- Finally, select “View” to access the form.

To authorize direct deposit through QuickBooks Desktop:

- You need a QuickBooks payroll authorization form,

- A voided check, and a deposit slip from the employee’s bank account.

These documents are for record-keeping purposes only and should not be submitted to QuickBooks Desktop.

E: Enable QuickBooks direct deposit forms for your employees.

Once you have finished setting up, the employee’s next paycheck will be via QBO direct deposit form. To see the required steps for your payroll, please check your options.

Online QuickBooks Payroll Version

- Go to the Payroll tab and select Employees.

- Choose the employee you want to set up for a direct deposit.

- Click on Start or Edit in the Payment Method section.

- From the Payment Method dropdown menu, select Direct Deposit.

- Select a Direct Deposit way, this can be a $1 sum or a portion for splits.

- Enable direct deposit to a single account.

- Set up direct deposit to two accounts.

- Opt for direct deposit with the balance being issued as a check.

- Type the routing and account numbers from voided check,

- Select Done.

For QuickBooks Desktop Payroll

Choose the checking account if an employee’s bank specifies a money market account, which is not accepted.

- Go to Employees and choose where it says Employee Place or Center

- Choose the employee’s name.

- When you the tab that says payroll data or info.

- Select Direct Deposit

- Choose to deposit into single or dual accounts.

- Type the bank details of the employees.

- Input the percentage figure to deposit into the primary account if choosing two accounts.

- tap the OK button to save the data.

- Type the PIN associated with a direct deposit when asked.

What Steps to Take if QuickBooks Direct Deposit Form is Late?

When QuickBooks direct deposit form for employees is not credited to their account on the scheduled day, you should take the following steps.

- Contact the bank and payer to verify the transfer’s status.

- Delayed direct deposits may result from system malfunctions or modifications causing processing delays.

- The issuing entity should inform you of the situation and the estimated timeframe for the deposit.

- If no communication is received, promptly contact the employer.

How to Set a Preferred Template for QuickBooks Direct Deposit Form?

You can suggest improvements for QuickBooks Intuit direct deposit form templates on QuickBooks through the Feedback option while signed in.

- Navigate to the Invoices tab in the left navigation bar.

- Click on the Pencil () icon of the invoice you wish to provide feedback for.

- Use the Feedback option.

- You will see a “What did you think?” field.

- Enter your feedback or feature request in that.

- If required, you can add a picture file.

- Click on Next.

- Enter your email address.

- Finally, select Done to submit your feedback.

How to Change or Update QuickBooks Direct Deposit Form?

To make any changes or updates to Intuit direct deposit form. You can do so by visiting the following link: https://www.conectier.com/blog/how-to-change-direct-deposit-in-quickbooks/

How to Access Employee Direct Deposit Authorization Form in QuickBooks?

To open the Intuit QuickBooks payroll employee direct deposit authorization form in the online version of the application, visit the payroll tax section. Once there, your employees can complete and put their signatures on the form.

- Locate the Taxes tab.

- Select Payroll Tax.

- Choose Employee Setup.

- Click on Bank Verification.

- Select View and Print to access and print the bank verification document.

How to Set Up QuickBooks direct deposit forms for vendors?

Set up QuickBooks direct deposit form for vendors to make payments more convenient and efficient. Follow the step-by-step instructions to streamline your payment processes and save time.

- Log in to QuickBooks Online and go to the “Expenses” tab.

- Click on “Vendors” from the left-hand sub-menu.

- Select the vendor you want to set up a direct deposit for and open their profile.

- Click “Edit” in the top-right corner of the page.

- Under “Payment and billing,” choose “Direct Deposit” from the drop-down menu.

- Enter the vendor’s bank account details and choose whether to make this their default payment method.

- Review the information and click “Save.”

- Use direct deposit as the payment method when creating or paying a bill.

Utilizing QuickBooks direct deposit forms provides convenient access to your earned income. The automated transfer system reduces costs and benefits both payers and employers. As a payee or employee, it offers enhanced security and faster access to your funds. By eliminating intermediaries and the need to physically deposit checks at a bank, direct deposit offers the most convenient method of payment transfer.

Frequently Asked Questions

Login to your Intuit Payroll account to get the Intuit Direct Deposit form PDF format. Go to the “Payroll” page and choose “Direct Deposit Authorization Form,” Next, select “Download Form” from the menu.

Intuit Direct Deposit form in PDF is a digital document that allows businesses to set up direct deposits for employees. It is the procedure of transferring payroll funds to their bank accounts.

Yes, direct deposits in QuickBooks have limits to protect against fraud.

No, you can only use Intuit’s direct deposit services to pay employees or contractors.

QuickBooks Direct Deposit is a feature that enables you to pay your employees directly to their bank accounts.

Requirements: QuickBooks payroll subscription, U.S. bank account, valid employee bank account information.

You can set up QuickBooks Direct Deposit by following the steps provided in the QuickBooks Payroll setup.

It takes 1-2 business days for employees to receive their Direct Deposit after processing.

Yes, QuickBooks Direct Deposit is safe and secure.

QuickBooks Direct Deposit costs $2 per employee per month.

If an employee’s Direct Deposit fails, you’ll get a notification and can either fix it or pay them another way.

Yes, QuickBooks Direct Deposit is only available for employees.

Yes, you can cancel Direct Deposit at any time by contacting QuickBooks Payroll support.

Go to “Paycheck List” in QuickBooks Online’s “Payroll” section, choose the desired paycheck, select “Direct Deposit”, and click “Print”.

To change a Direct Deposit in QuickBooks, select the paycheck from “Paycheck List” in “Payroll”, click “Edit”, change the Direct Deposit details, and submit the changes.