Some people may try to find the best saving option while planning for retirement. For such a situation, going with the QuickBooks 401k plan can be thoughtful. In this plan, an employer pays some amount of salary to the employee. The employer can also deduct some amount as a saving that can be taken out by the employee during retirement. After you plan to take up the 401k plan, you may also set it up on QuickBooks. So, knowing the procedure to set up the plan can be important.

The 401k plan in QuickBooks Desktop can be processed automatically through the EZ Setup button. Based on your preferences, you may set up the plan manually by using the Custom Setup tab. You can also set up the Roth 401k plan in QuickBooks Online Payroll to make the withdrawal process easier in retirement. The Edit feature will help you out with it.

How to Set Up a 401K Account in QuickBooks Desktop?

Setting up an account for the 401k plan in QuickBooks Desktop can help in deducting a part of the employee’s salary on a pre-tax or post basis. You may try setting up 401k in QuickBooks Desktop automatically with the EZ setup option. You need to move through the Lists tab in QBDT to reach this feature. You can also manually set up your own account as well as preferences by customizing them in QuickBooks Desktop Payroll. The Custom Setup button available in the software will let you set it up.

Method 1: Through EZ Setup Automatically in QBDT

Users can set up 401k in QuickBooks Desktop automatically. Through the EZ Setup option, you can start the automatic process. Search for the Lists button in QBDT and move to Payroll Item List. Then press the New option. Pick the EZ Set Up tab and head to Next. Further, go through the prompts appearing on the screen.

These instructions will make you understand how to set up 401k deductions in QuickBooks Desktop automatically along with the account:

- Launch “QuickBooks Desktop”.

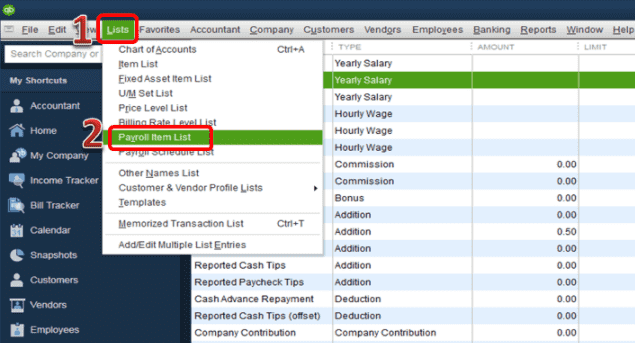

- Find “Lists” in the menu.

- Tap on “Payroll Item List”.

- Press the “Payroll Item” option.

- Hit “New”.

- Then choose “EZ Set Up”.

- Move to “Next”.

- Keep following the prompts that appear on the screen.

- Now, the payroll item has to be edited.

- Ensure to enter all the required vendor details. In the process, you may also enter any deductions.

- Save the information and your 401(K) account will get set up.

Important: While you execute this QuickBooks 401k setup method, try not to change or adjust the tax settings(Adjust Sales Tax Rate) that have already been set.

Method 2: Via Custom Setup Manually in QuickBooks Desktop Payroll

QuickBooks Desktop users can set up the 401k account manually with customizations. Here, the Custom Setup will turn out to be the most suitable option for performing the method.

The Lists menu is to be chosen at first. Then push the Payroll Item List button and press Payroll Item to set up 401k in QuickBooks Desktop Payroll. Next, click on the New tab and tap on the Custom Setup option to go ahead.

- Head to “Lists” in “QBDT Payroll”.

- Click on “Payroll Item List”.

- Hit “Payroll Item”.

- Press the “New” option.

- Pick “Custom Setup” afterward.

- Select the “Next” tab in this direction.

- Next, choose “Deduction”.

- Opt for “Next”.

- The item’s name is to be entered in the field of “Enter Name for Deduction”.

- Push “Next”.

- Go to the drop-down menu of “Liability Account”.

- The liability account has to be selected that will be later needed for tracking the deduction.

- Now, you have to choose “Next”.

- Move to the window for “Tax Tracking Type”.

- Then pick the tax tracking type that will match the plan type.

- Hop to “Next”.

- In the column of “Payroll Item”, select the items that you want to get calculated after the deduction.

- Click on the “Next” tab.

- Visit the page “Calculate Based on Quantity”.

- Now, opt for the “Neither” option.

- The “Next” feature has to be chosen.

- If you find the “Gross Vs. Net” page appearing on the screen, you need to pick “Gross” in case the deduction amount contains the percentage of the gross earnings of the employee.

- If the dollar amount is fixed, choose “Net”.

- After that, select the “Next” option.

- Visit the window of “Limit Type”.

- Then the field is to be filled up if the amount and the deduction rate applied to most of the employees are the same.

- Tap on the “Finish” option.

Note: The above methods can also be used for QuickBooks 401k for the Desktop version.

How Can You Set Up a 401K Company Match in QuickBooks Desktop?

While selecting the 401k plan, you may get a company match. A company match would mean that you will be receiving a matching amount from the employer.

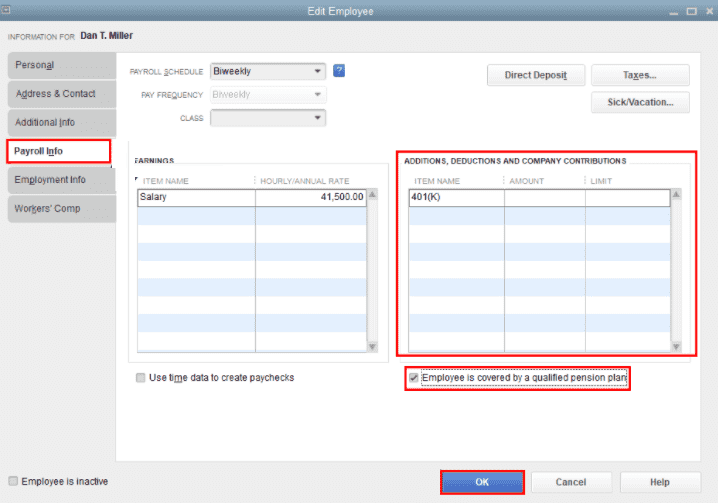

Setting the company match 401k can be processed through the Payroll Info button in QuickBooks Desktop. Click on the Employees button in the software. Then you need to click twice on the employee’s name whose 401k company match account is to be set up. Head to the Payroll Info option. After that, make a move to the section of Additions, Deductions, and Company Contributions.

- Open “QuickBooks Desktop”.

- Tap on the “Employees” option.

- Click twice on the name of the employee.

- Move to “Payroll Info”.

- Go to the section “Additions, Deductions and Company Contributions”.

- The 401(K) payroll has to be added now.

- Then provide the particular rate for the selected employee.

- Press “Ok”.

After pressing Ok, your 401(K) payroll will be set up for the chosen employee. Likewise, if you want to set it up for other employees, repeat the steps from 1-8.

How to Set Up a Roth 401K in QuickBooks Online Payroll?

Roth is a type of 401k plan. When you withdraw any savings during retirement, it can be entirely tax-free. In QuickBooks Online Payroll, 401k can be set up for Roth for making contributions through after-tax dollars. Select the Payroll tab in this software. Next, the Employees button is to be chosen. Head to the section of Deductions & Contributions. Tap on the Edit tab. In the Deductions for Benefits section, choose to Add a Deduction. Opt for Retirement Plans in Category afterward.

- Go to “QuickBooks Online Payroll”.

- Choose “Payroll” from the menu.

- Pick the “Employees” option.

- Move to the section of “Deductions & Contributions”.

- Press “Edit”.

- Then head to the section of “Deductions for Benefits”.

- Tap on “Add a Deduction”.

- For the “Category”, choose “Retirement Plans”.

- In “Type”, opt for “After-Tax Roth 401(K)”.

- A description is to be mentioned.

- Click on the “Ok” tab.

Once you have completed the above steps, your Roth 401(k) will be set up in QBO Payroll.

Conclusion

The 401k plan in QuickBooks or its versions can be the most useful while planning savings for retirement. Different methods to set up this plan in QB were described in our blog. We also shared the process to set up a company match in QBDT. Furthermore, we highlighted the steps for setting up Roth 401k in QuickBooks Online Payroll. Based on the QuickBooks 401k plan type you choose, we hope that these methods will be useful for the setup.