QuickBooks provides a feature named the Undeposited Funds Account where all the invoices and sales receipts are kept on hold prior to the formation of a bank deposit. This not only makes bank reconciliation easy but also helps in a company’s workflow. In most versions of the software, you can find the undeposited funds or the account for them in the Deposit To drop-down. For using these funds or the account in QuickBooks, the Receive Payment button is what you need to press.

Even to know how to use undeposited funds in QuickBooks Online, the approach remains the same. The reading assists you with the uses of these funds. You will also get to know how to locate the undeposited funds in the accounting software.

What is the Undeposited Funds Account Used for in QuickBooks?

Undeposited Funds Account is a very useful feature provided by the Intuit software. It temporarily comprises all the invoices and sales receipts by itself before depositing any of these to your bank account. This feature simplifies the bank reconciliation process by combining the invoices with the sales receipts.

Why Do You have to Use Undeposited Funds in QuickBooks?

There are times when, in QB, you may go to the Chart of Accounts and not notice the Undeposited Funds account option. Not knowing the use of the account may be a reason behind this. It will be helpful to know that the undeposited funds in QuickBooks are mainly useful for holding your payments.

There are also other uses of these funds or their account. The following will let you know what is the undeposited funds account used for in QuickBooks:

- It keeps checks and cash before submitting them to the bank.

- By using an external processing service, it helps in your workflow.

- The account also shows one single deposit which comprises the sum of the payments made by the customer.

- It makes the reconciliation process much simpler and reduces errors while matching.

- You can easily edit the deposits according to your wish.

Some other uses of the undeposited funds are:

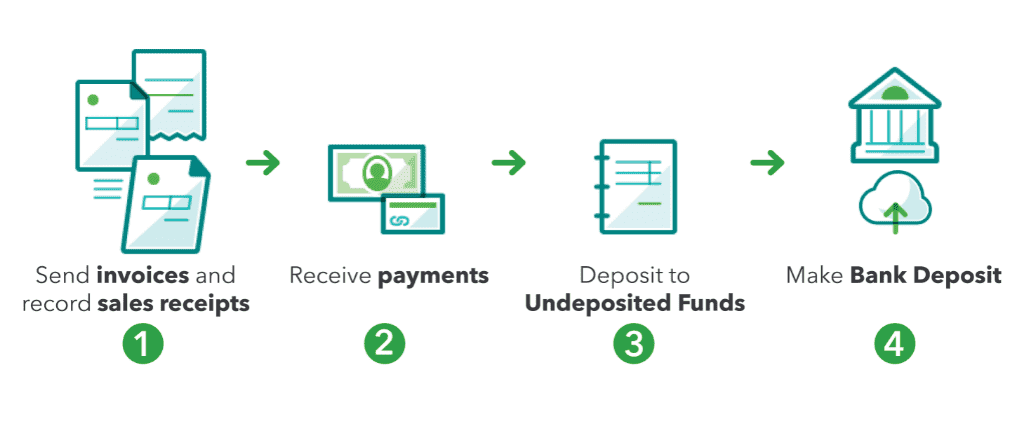

- They let you record the sales receipts.

- You can receive the payments from a customer and also send invoices to him/her.

- You may make a deposit in your Undeposited Funds account.

- Additionally, you can make a bank deposit of the amount.

3. Where to Find the Undeposited Funds in QB?

In QuickBooks, you will find the Undeposited Funds Account in the drop-down menu of the Deposit To option. To easily find this option, you can tap the +New button available in the software. Once you have found the account, you can start using it.

- Click on “+New” on the QB homepage.

- Move to the “Receive Payment” button.

- Next, from the “Customer” drop-down bar, choose the customer.

- Locate the drop-down of “Deposit To”.

- Press the “Undeposited Funds” option.

Using Undeposited Funds in QuickBooks

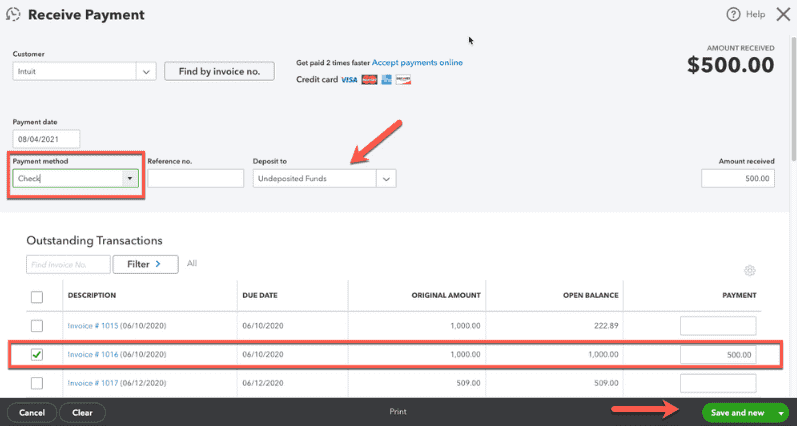

To use the Undeposited Funds in QB, you need to visit its account. To locate the account, click on the + icon. Also, tap on the Receive Payment option. Opt for your customer among the options provided in the drop-down menu. You will see that the selected customer’s invoice is appearing on the list. After that, pick the Payment Method. Further, confirm the amount and press the tab for Save and New.

The following directions will let you know more about how to use undeposited funds in Quickbooks:

- Visit the “Undeposited Funds” account in QuickBooks.

- Click on the “+” icon.

- Tap on “Receive Payment”.

- Among the drop-down options, opt for your customer.

- The selected customer’s invoice will appear on the list.

- Select the “Payment Method”.

- You also need to confirm the amount.

- Press “Save and New”.

How to Use Undeposited Funds in QuickBooks Online?

To understand how to use undeposited funds in QuickBooks Online, you need to run this program and place the payments in an account. This account will be of the Undeposited Funds. Then you have to categorize your transactions and for that, you can click on the + icon. Then Tap on the Receive Payment option. Also, pick your customer from the Customer drop-down menu. Now, from the Deposit To drop-down, you need to opt for Undeposited Funds.

Keep following the steps below to go through the rest of the procedure.

- Run “QBO”.

- Place the payments in the account of the “Undeposited Funds”.

Then, you need to perform the following steps to categorize your transactions:

- Click on the “+New” symbol.

- Tap on “Receive Payment”.

- From the drop-down of “Customer”, pick your customer.

- Next, opt for “Undeposited Funds”. You can find this in the “Deposit to” drop-down bar.

- Enter all the required details.

- Press one of these

- “Save and New”

- “Save and Send”

- “Save and Close”

After you have followed these steps, you need to proceed with the Sales Receipt. The procedure is as follows:

- Hit “+New”.

- Go to “Sales Receipt”.

- From the drop-down bar of “Customer”, choosing your customer is required.

- The drop-down named “Deposit To” has to be tapped.

- Click on the “Undeposited Funds” option.

- Enter all the other information required.

- Press “Save and New/“Save and Send”/“Save and Close”.

Once you have carried out these steps, follow the next process to review the “Undeposited Funds Account”:

- Visit the “Accounting” button in the software.

- Tap on “Chart of Accounts” after this.

- Search for the “Undeposited Funds” account in the list of “Chart of Accounts”.

- Hit “View Register” and finish this process.

Conclusion

As you would now know, undeposited funds work like a feature. Provided by Quickbooks, it lets you temporarily record your invoices and sales receipts. In this blog, we shared several uses of undeposited funds and their account. Also, we talked about the location of the undeposited funds for your assistance. Furthermore, we provided you the steps relating to how to use undeposited funds in QuickBooks and QBO.

To read about how Wave accounting exports to QuickBooks, go through this page. Along with this, you may read our other blog on how to record Stripe fees payments in QuickBooks.